Wednesday, March 29, 2017

Tuesday, March 21, 2017

4 Difficult Issues in Payroll Processing

Many companies today delve into business with full force without even taking cognizance of the brass tacks of Human Resources management. Some of these companies soon run out of luck and are seen rushing out of business at a time when the “smart” ones are busy making waves and leveraging their chances with payroll processing and efficient HR management.

The “smart companies” and what they use

Do you fall in the category of those who still use manual systems to process payroll? Well, you have to understand that avoiding pitfalls in payroll is just as paramount as your company’s existence. Overlooking the fact that manual payroll processing systems are archaic, these systems have shown incompetence due to a number of payroll difficulties that they fail to alleviate.

Now let’s take a look at the top 4 difficulties experienced when processing payroll:

Setting up Employees Correctly

Setting up your workforce aright with detail to staff duties and functions is very important to your payroll. Your business, as well as any other company out there, have the option of hiring workers either as a contract staff, freelancer or as a permanent employee. You get things wrongly once you start classifying everyone working for you as your employee.

Wrong classification of workers pose serious problems as businesses are ever-answerable when it comes to paying their employees’ taxes and any other fine.

Calculating the Proper Deductions

One of the most challenging part of payroll is taking the time and stress to calculate and process deductions from employee remuneration. This issue is commonly eminent across businesses and HR departments because federal, state and local law requirements should be followed down to the last detail, especially when making deductions from employee salary.

Many companies find this issue so difficult that they resort to payroll automation services like On-time Web.

Utilizing Direct Deposit

After necessary tax funds have been processed and deducted from both employee and company earnings, your decision about deposit matters a lot. There are several complex rules and policies guiding each form and timing of deposit as they all depend on your business’ tax obligations.

Although using direct deposits (electronic paychecks) has its requirements, payroll automation is considered to be cost-effective and efficient when it comes to unravelling errors or solving related difficulties.

Calculating Time ticket entries

The process of entering employee time ticket requires serious attention down to the very last detail. Any incorrect entry of time ticket through manual payroll system could single-handedly taint the overall record. Trying to locate the mistake would not only amount to waste of your precious time and resources, the headache that comes with is definitely going to be unbearable.

Solving Employee Attendance Issues through Payroll Automation

A smart HR manager that intend to champion all the complexities payroll processing should opt for a single best, cost-effective solution – Payroll automation. Payroll integration is included among the spectrum services we offer here at On-time Web. Our team of experts specialize in providing clients with bespoke payroll software and services that are integrated custom features for business needs. Visit our website today www.on-timeweb.com

Monday, March 6, 2017

Solving The Top 6 Problems With Timesheets

Finishing and submitting time sheets seem like a simple task to do. Yet, most employees timesheet management pose a perennial challenge for businesses offering technical and professional services whether they are due daily, weekly or monthly.

Timesheets are very important aspect of the delivery process for professional services organizations for two major reasons:

- They help businesses determine whether resources are being allocated appropriately and are yielding positive returns,

- They enable organizations to provide a comprehensive invoice and report to show clients that they are getting the resources they paid for.

If timesheets are important to any business, shouldn’t the time management procedures be of utmost importance to how you manage your business?

Honestly, nobody likes timesheets! Nevertheless, the inevitable effects of poor timesheet management includes

- Late time sheets that impact cash flow with clients and customers.

- Inaccurate time sheets which will affect due payments to your employees.

- Missing timesheets which might hinder opportunities to invoice customers because your employees haven’t recorded their billable time.

To avoid these problems, timesheet compliance is imperative. When using paper timesheets, there is no way to avoid late entries, employee/manager errors, late/missing time sheets, data entry errors, and input errors. It should, but for many professional services firms, it isn’t. So how can time management processes be improved?

First let’s look at some problems organizations face with the timesheet management process:

LATE AND MISSING TIMESHEETS

For many years, most companies have used paper time sheets, which resulted in a multitude of difficulties including missing sheets and storage issues. The biggest issue comes down to accuracy, as there are mostly discrepancies between time-worked and time-reported.

There are employees who turn in late timesheets and this can be a challenging problem for employers. Sadly, it is the obligation of the employer to pay employees on the agreed payday regardless of whether a timesheet has been submitted. There is no law that allows an employer to withhold payment until the timesheet has been submitted.

A practical way to manage this issue is to have a defined policy and procedures on the reporting hours worked and the deadlines. Educating your employees on the expectancy for completing the timesheets on time is key to ensuring that you are abiding with wage payment requirements.

You can treat this policy as a disciplinary measure if it continues even after expectations have been communicated. Withholding the paycheck to gain compliance may subject the firm to potential claims for unpaid wages.

As a last resort, you can upgrade your timekeeping to an automated time tracking system that calculates employee’s hours and overtime. This method would eliminate any lateness because it is the simplest alternative to strenuous time card calculations, and attendance records would be instantly available to you.

ILLEGIBLE AND INACCURATE TIMESHEETS

It is easier to prevent fraud than to detect it and stop it, particularly in a firm as large as on-time web. We always recommend that accurate measures should be adopted to prevent illegible or inaccurate records from occurring in the first place.

The employer should delegate responsibility for submitting time sheets in a clear format for easy referencing and tracking. Where electronic timesheets are used, procedures should also include the following:

- Users of electronic timesheet systems should be required to change their password on a regular basis.

- The user should be logged out automatically when the user’s session has been inactive for a specified period of time.

- Users should be prevented from logging in to the system after three incorrect attempts.

CALCULATION AND MANUAL ENTRY ERROR

As technology advances at a blazing speed, the ability to automate the timekeeping process has become easier to implement, simpler to learn, and increasingly inexpensive. On top of these improvements, the best of breed systems are delivering higher and higher returns on investments due to added functionality.

A calculation error occurs when an employee does not receive the correct dollar amount in a paycheck. The amount could be either more or less than what should have been received and is the result of calculation or manual entry error.

If there is a case of an error in the amount of pay, the employee should immediately bring the discrepancy to the attention of his / her employer so that appropriate corrections can be made as quickly as possible.

Once a pay error is discovered, the department must assess the reason why the error occurred and take the appropriate action as outlined below. The first step is to confirm that the information entered onto the paperwork or in an electronic submission was correct. If it was correct, the pay error correction process is used to report calculation errors to the Payroll.

Calculation errors such as Underpayments, Overpayments and Stop Payment each has its own requirements for address.

What’s more?

Make Timesheets Fun

Make your timesheet submissions fun. Here are some ideas:

- Award the first person to submit their timesheet each day.

- Create a leaderboard of best timesheet submitters throughout the month. You could give point values for different accomplishments, such as first submitted, submitted without errors, Hold a drawing for gift cards for everyone who submits timesheets on time. Reward the top performer at the end of the month or quarter.

- Hold a drawing for gift cards for everyone who submits timesheets on time.

- Make it team-based by rewarding units. Track performance throughout the year and hold an annual recognition party.

Set goals for the company or for teams and celebrate when the goals are reached—then set new goals. We hope this guide was helpful. Please visit our website on-timeweb.com to know more about our services.

Tuesday, January 10, 2017

Everything you need to know about SaaS Software

There is an increasing demand for SaaS software in the market today. Ranging from small businesses who can’t afford to get on demand software manually to big enterprises that need work to be done precisely, SaaS is the best choice to rent. This article explains all those things that you need to know about SaaS software.

1. What is SaaS software?

SaaS refers to Software as a Service, sometimes referred to as on-demand software. It relates to providing on-demand software to companies and businesses that is essential for their day-to-day transactions. The license, however, works on a subscription model and requires periodic renewals. Some of the most common SaaS services include accounting, collaboration, payroll processing software and time and attendance management software.

2. How does SaaS software work?

Companies who want to use SaaS services in their businesses need to contact the service provider. Companies are asked to pay rent and are allowed to use the software through the subscription period. However, SaaS users need to install MSP on their computers. MSP or Managed Service Providers are that software that runs only on those devices which are owned by service providers. After the end of the subscription period, the companies can either renew it or go for an alternative.

3. SaaS software vs. Traditional software:

Traditional software came up with the hassle of installing the software, which led to additional costs. However, upgrading it or updating it depended upon the user. It also meant that by purchasing the software users are provided only with usage license and not the ownership. However, SaaS has managed to change this scenario. It works on a subscription basis, and users have to rent the services for use. They usually run on the server of the service provider and hence, they allow the companies to specialize the software as per their needs. SaaS software makes the work simple and easy to businesses.

4. Advantages of using SaaS software:

- Lower costs: The cost is split amongst many companies that use the SaaS software and thus the cost an individual business has to incur is generally less than traditional software purchased. It allows smaller businesses, that can’t purchase traditional software due to enormous licensing costs, to have software and improve their efficiency.

- Saves time: SaaS software is pre-installed and also configured. This helps eliminate most of the time spent on configuration and installation.

- Upgrades: Traditional services require users to pay for getting their software upgraded to the latest level. However, SaaS service providers upgrade the services to the latest level automatically, and these costs are distributed among a large number of users.

- Easy to use: SaaS software may offer customization according to business needs. This helps the business to get past the complicated procedures and stick to the simple procedures and options that they require.

5. What is Time and Attendance SaaS software?

Time and attendance software uses automation to track employee presence. The access to this software is provided to Payroll and HR departments. This software provides summary sheets at the end of particular periods depending upon the software. SaaS providers charge the businesses on the number of employees tracked, making them an especially good fit for small to medium-sized businesses.

6. Advantages of using Time and Attendance SaaS software:

- Cost effective: As SaaS service providers don’t charge installation fees they are the best choice to make. Unlike licensed software, which is costly, SaaS works on a subscription basis. Hence users can track the attendance of employees at a lower cost.

- Less technological help: SaaS software requires no setup and no special hardware. It doesn’t need capital expenses to spend on compatible computers. They are also incredibly easy to operate. Thus there is less IT strain by using SaaS software.

- Secure way to store your data: This offers a recorded proof to show to your employees about their presence. The licensed software provides an online storage to store your data, which is stored in data centers of service providers. With increasing cyber fraud, SaaS offers the best advantages.

- On subscription basis: All SaaS software including time and attendance software work on a subscription basis. Hence the commitment you need to invest in this software is less. This ensures that if you don’t like a service provider, you can switch to another at minimum cost.

7. Employee experiences:

SaaS software for time and attendance creates a positive impact on employees and increases their efficiency. Knowing that powerful software is keeping a check on them is essential to keep hard-working employees motivated. It also prevents time sheet fraud, which is of primary concern to businesses. It encourages employees to work as a team and makes administration of employee time easier, which helps payroll and HR departments. It also contributes to achieving mobility in time and attendance management, and the software makes it easy to read the summary of data.

SaaS service providers are competing among themselves to make their brand the best on the market. SaaS gives the users a wide range of options from which to choose the service provider. It is a next step forward in the software world.

Monday, July 18, 2016

Sunny California and double time laws

New Features! Sunny California and double time laws

https://goo.gl/fLHDp0

#newfeatures #OnTimeWeb

The Fair Labor Standards Act (FLSA) has no requirement for double time pay, but the California Department of Industrial Relations does, and the state laws trump the Federal laws when it comes to additional protections for workers. Other than California, some companies may have their own double time pay rules. Easily create custom rules and set them company wide or to specific employees.

https://goo.gl/fLHDp0

#newfeatures #OnTimeWeb

The Fair Labor Standards Act (FLSA) has no requirement for double time pay, but the California Department of Industrial Relations does, and the state laws trump the Federal laws when it comes to additional protections for workers. Other than California, some companies may have their own double time pay rules. Easily create custom rules and set them company wide or to specific employees.

Thursday, July 14, 2016

Upgrade Your Timesheets To The Cloud

Why tether yourself to a specific computer for managing employee timesheets? Why purchase software for every single computer or user that needs to access the timesheets? What if there was a cost effective solution that didn’t require software or the hassle of making certain you always have the latest version? That is exactly what our On-Time Web cloud based software does.

What Does Cloud Actually Mean

You’ve probably heard quite a bit about the cloud or cloud services, but you may not think these are the right solutions for you. The main myth surround cloud software or Software as a Service (SaaS) solutions are you have to give up control and security just to save money. This couldn’t be further from the truth.

A respectable provider gives you control to customize software and settings just like you would any other software application. The only difference is the software is stored on the provider’s server instead of your own. As far as security goes, every provider has their own security solutions which are often more secure than your own in house security.

Using SaaS cloud solutions means the service provider, in this case On-Time Web, hosts the software. You then have access from any computer via a web portal. You never have to worry about a computer crashing or data being lost again. Since we back up our secure servers daily, your data is always safe even if all your computers crash or are infected with viruses.

Benefits of Upgrading

Upgrading to cloud based web timesheets and web time clocks reduces the cost of software and hardware. We handle all software upgrades and backups. We take care of server and other hardware upgrades. Implementation is as easy as customizing the web portal to your business and learning how to use the software. All you pay is a low monthly fee.

Cloud based timesheets and time clocks are accessible from more than just computers. Use mobile devices, such as smartphones and tablets, as well. This means you have access to the system even when you’re out of the office.

The scalable solutions are able to grow with you. Anytime you need to upgrade due to growth, contact us and we handle everything. No waiting, no buying new software, no hassle. It’s simple. Upgrading means you save money, time and stress. Why make managing payroll difficult when web based timesheets are so much simpler?

Sign up for a no-hassle 14 day free trial and see how cloud timesheets can benefit your company.

Friday, July 1, 2016

New Features – Employee Leave Accruals

We have just released several new enhancements to On-Time Web. Our biggest new feature is the integrated employee leave accruals. Contact us for more information or current customers can read the help manual.

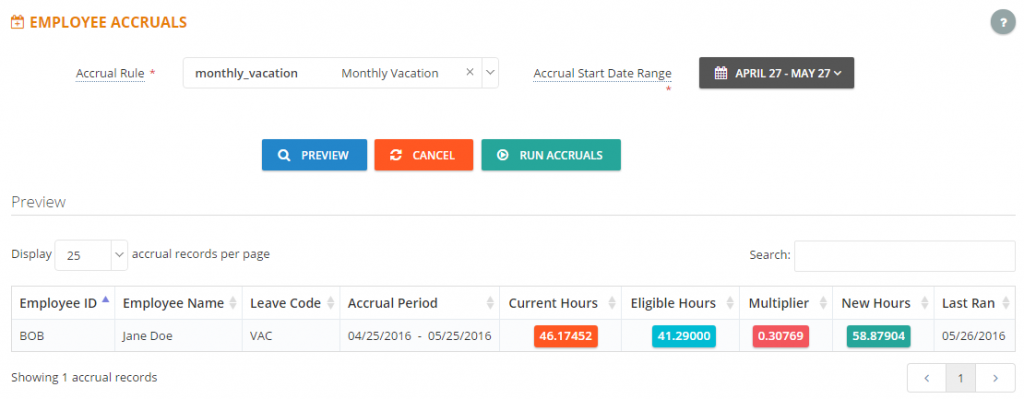

Employee Leave Accruals

Create accrual rules for hourly, monthly or annual company policies. You can create unlimited custom accrual rules that contain as many levels of years of service as you need . Those rules can then be applied to different employees’ leave codes for each employee. Choose to calculate monthly or annual accruals automatically based on the rules or to manually run them with a click of a button. Hourly rules are automatically applied when employee time is approved. If the time is unapproved that accrued time is removed from the employee’s balance.

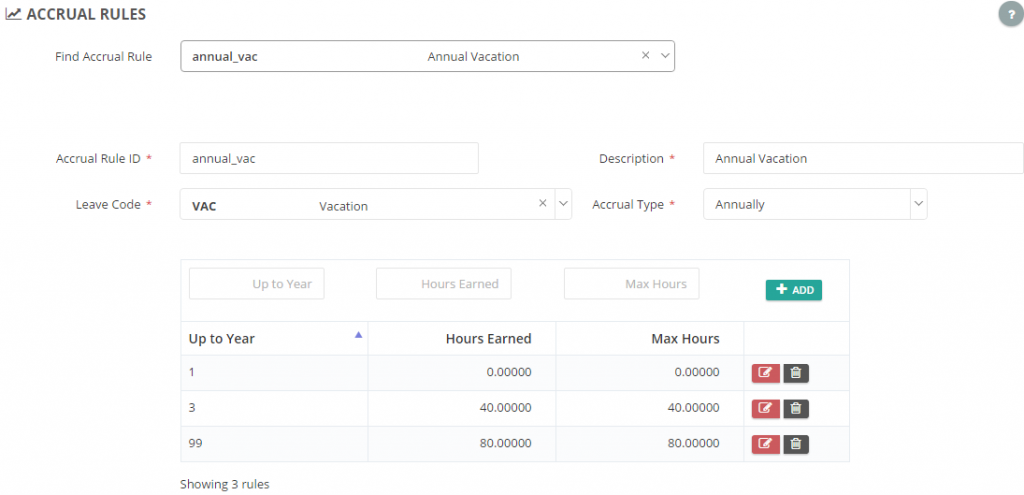

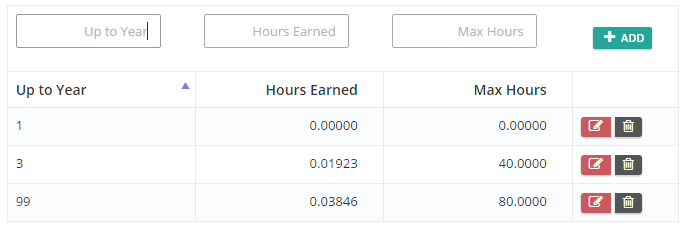

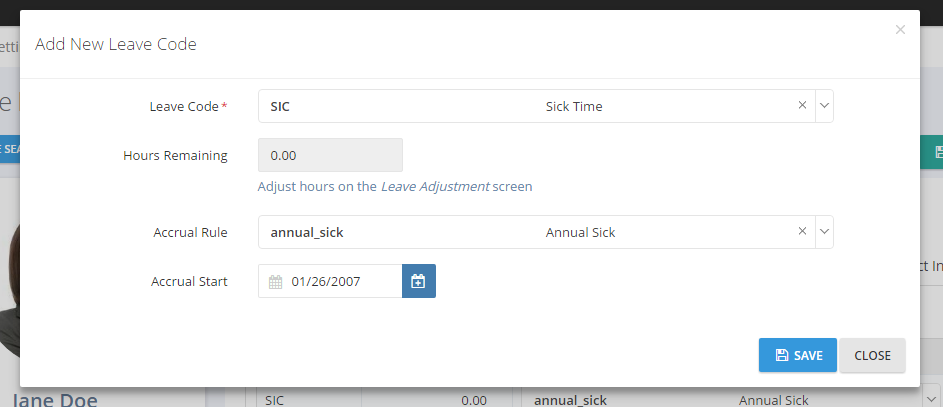

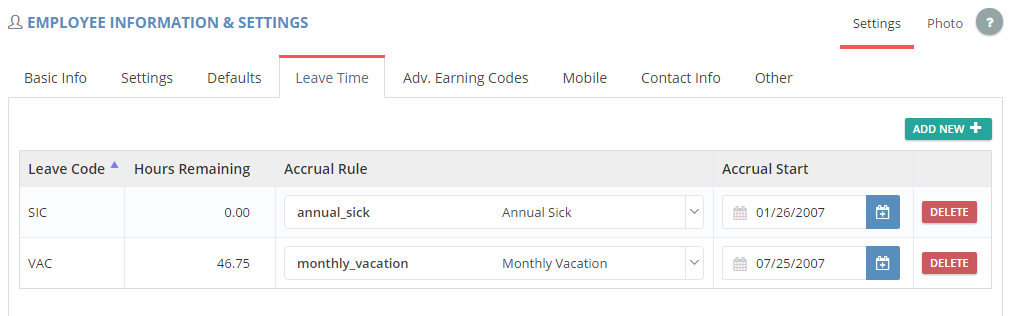

Accrual Rules screenshots:

Annual Example:

Monthly Example:

Hourly Example:

Applied to the Employee:

Manual accrual screen:

2) Auto-In & Auto-Out Time Completion Options

There are two new options on the Punch Settings tab in Settings & Defaults that enable/disable assistance with employee punches. Previously, On-Time Web would always attempt to assist with employees’ “bad” punches. For example, If an employee was punched IN and they tried to punch in again the system would make anauto-out punch for that first record in order to complete it, and then make the new IN punch. On the other side of that if an employee was not punched IN at all and punched OUT the system would do an auto-in to make a complete record. This sometimes caused more confusion than offered help with employee time. We now have options to enable or disable that assist functionality.

3) Personnel Reports

There are 3 new employee personnel reports. The Contact List shows address and contact information for the selected employees. The Employee Anniversary Report shows the selected employees’ anniversary date and total years of service based on the hire date. The last report is the Important Dates Report which shows all important dates relevant to each employee such as hire date, termination date, last login date, and last time transaction date.

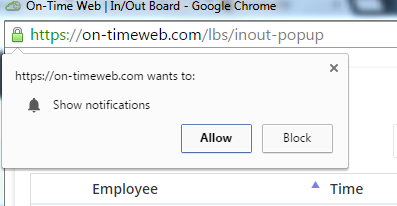

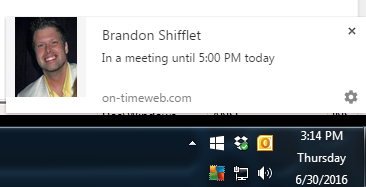

4) In/Out Board Pop-Out Window – Desktop Notifications

If using the In/Out Board in the Pop-Out Window there is an ability to view new notifications from employee status changes. The first time you must allow on-time web to access certain resources. The popup window will ask you if you want to allow notifications. Once you have said yes evertime an employee’s status changes you will get the notification directly on your desktop no matter what windows you may have open. This option is available for Google Chrome, Safari on Macs, FireFox, Edge and Opera (Not supported in IE).

5) New Employee Status Option

There is a new option on how long to keep employee status messages on the In/Out Board. if the option is set to 0 days then the status is automatically cleared after a new punch has been made. Otherwise it is kept for the set amount of days and then deleted.

6) New Login Screen with Login Message

The login screen has been redesigned to look friendlier when it comes to background images and company logos. There is also a new option to set a short login screen message. that shows right below the company name on the login screen. You can change the default login screen message under Themes.

7) Other Miscellaneous

– Menu Changes: Settings main menu name has now changed to Company Setup

– Reallocate Time: This screen can now do bulk edits for multiple employee records that meet the criteria instead of just splitting time.

Subscribe to:

Posts (Atom)